Leave a Legacy Gift

When thinking about your legacy, please consider including the Food Bank.

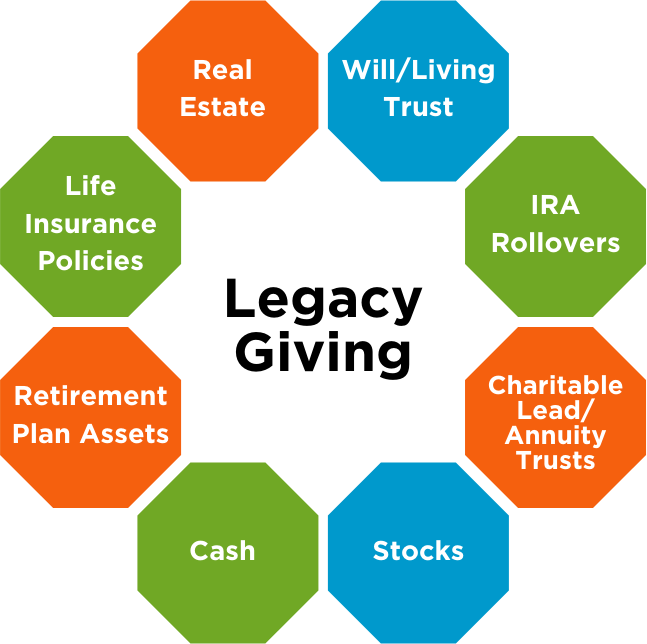

Legacy giving is a powerful way to make a lasting impact in your community. Ensure your assets are put to their best philanthropic use and distributed in a way that reflects your most cherished values. There are a variety of ways you can leave a legacy gift*, often referred to as planned giving.

We are here to answer your questions and help find the right gift for you.

Legacy Gifts Include:

- Real Estate

- Life Insurance Policies

- Cash

- Stocks

- IRA Rollovers

- Wills or Trusts

- Charitable Annuity Trusts

- Charitable Gift Annuities

- Retirement Plan Assets

- Pledged gifts

- Securities

Smart Ways to Give

A simple designation in your will or trust. Retain control of your assets during your lifetime. Adjust your gift if circumstances change.

Transfer cash, securities or other assets to the Food Bank in exchange for fixed annual payments for life that are partially tax-free! The remaining principal will benefit the Food Bank. Start payments now or later. Potential savings on capital gains tax.

Provides the Food Bank with an income stream for a specified term while allowing you to pass on appreciating assets to your heirs in the future. Appreciation in the trust passes tax-free to your heirs. Reduces your gift and estate taxes. Reduces or eliminates transfer taxes due when principal reverts to your heirs.

Transfer assets into a trust that pays income for life or a fixed number of years. The remaining principal will benefit the Food Bank. Receive an income tax deduction. Potential savings on capital gains tax.

A gift of cash or a pledged gift to be paid over time is a straightforward way to donate and qualifies for tax benefits. Additionally, gifts of securities and mutual funds help avoid capital gains tax.

Donor-Advised Funds (DAFs) have become a popular philanthropic tool for many donors. A DAF is a philanthropic vehicle that allows you to make a charitable contribution, receive an immediate tax deduction, and then recommend grants from the fund over time. By supporting us through your DAF, you can streamline your giving process and potentially grow your funds tax-free before making the grant, enabling you to make a larger impact.

Name the Food Bank as your life insurance policy beneficiary. Simple to do. Irrevocably donating an existing policy you no longer need may provide you with an income tax charitable deduction.

If you are 70½ years old or older, you can make a gift directly from your Individual Retirement Account (IRA) to the Food Bank of Contra Costa and Solano. These Qualified Charitable Distributions (QCDs) can satisfy your Required Minimum Distribution (RMD) without increasing your taxable income. This is an efficient way to make a meaningful contribution while enjoying tax benefits.. Donate up to $100,000, potentially increasing charitable giving to $200,000 for married couples.

Name the Food Bank as a beneficiary of an Individual Retirement Account (IRA), 401k or other retirement plan. Retain control of your assets. Simple to do. May avoid significant tax burdens for your heirs. Adjust your designation if circumstances change.

Donating stocks or other appreciated assets, such as bonds or mutual funds, is a powerful way to support the Food Bank. When you transfer these assets directly to us, you can potentially avoid paying capital gains tax on the increase in value since you purchased them. Furthermore, you may be eligible for a tax deduction based on the full fair market value of the asset at the time of the gift. This means your contribution could have a larger impact than if you had sold the assets and donated the after-tax proceeds.

Steps to Donate Stock

- Transfer Stock

Contact your broker to transfer your shares or call our Vanguard contact at: 877-662-7447. Transfer stock to Vanguard, account number 28948289. For electronic stock transfers, the (DTC) number is 0062 - Notify Us

Notify us of your donation by completing this stock donation form or call us at 925-676-7543 ext. 265.

To protect your privacy, your bank will not disclose that you have made a stock donation. You must complete the stock donation form to receive a tax receipt letter.

Four easy steps to make a legacy gift

- Step 1 – Decide if leaving a legacy gift is within your financial forecast.

- Step 2 – Decide which type of gift best aligns with your financial planning goals.

- Step 3 – Consult with your financial or legal advisor to confirm your legacy gift will be implemented when you are ready.

- Step 4 – Please contact Vice President of Development and Communications Kim Castaneda at (925) 676-7543 x 265 or kcastaneda@foodbankccs.org to let us know you plan to include the Food Bank in your will so we can keep you up to date on our work.**

* It is recommended you consult with your tax or legal advisor prior to making a legacy gift.

** There is never an obligation for requesting planned giving information. All of your information is maintained confidentiality. We never release, share, sell or rent names, addresses, etc.